One of the First Financial Scams in History: Tulip Crisis

One of the First Financial Scams in History: Tulip Crisis

Would you sell your house to buy a tulip? Some people almost did that

Financial scams are some of the most powerful frauds ever. They can throw the entire country or worse even the world in turmoil. We frequently hear of a financial scandal breaking families and burning holes into people’s pockets. We hear how prices have plummeted or sometimes broken through the roof and how people have lost jobs.

As a student of Commerce, we learn about business ethics and all the new laws and governance codes enforced on businesses yet the scandals just keep cropping up like annoying website pop-up ads.

‘Money is the root cause of all evil,’ isn’t it? Fascinatingly so, this has been the case ever since money was invented.

Paper money was a method of currency. Soon this was not enough. People wanted to make their money grow for them without having to slog for it. And this idea has stuck in human minds till date.

Where it all began

In the late middle ages, the Netherlands were leading colonists. The country was wealthy and the most prosperous of the 17th century. In today’s terms, the revenue of the Dutch East India Company is thought to have been multiple times that of Apple Inc ie. $7.9 trillion in today’s terms! Where would all this money go?

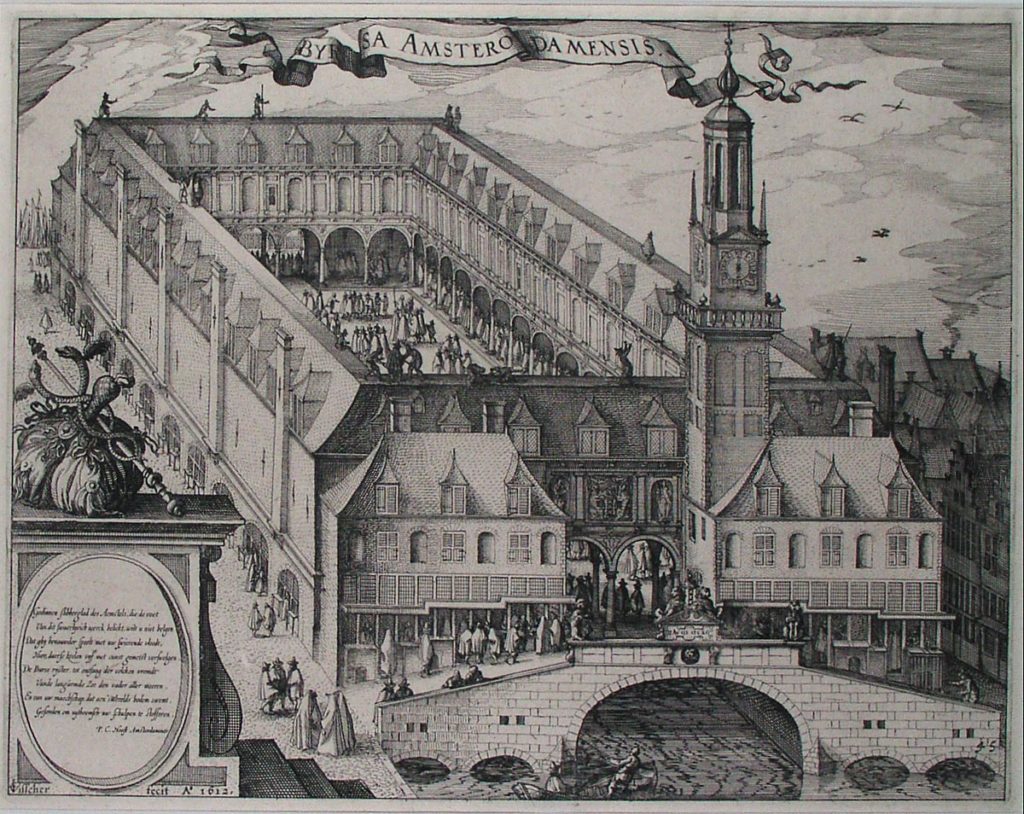

To solve this problem, all the newly rich classes and the industrialists of the Dutch East India Company set up a stock exchange. Shares or part ownership of companies could be sold to people for a price. This price kept fluctuating with the changes in the demand and supply forces.

Forget these technical commercial concepts, what this stock exchange introduced was a huge cultural phenomenon. People loved this new game. Some won big cartloads of money and became rich overnight whereas some lost all they owned in this gamble. Women sold their jewellery, others even sold their homes to participate in the Stock Exchange. And just when it couldn’t get better, other geniuses introduced more financial instruments.

And that is how things began to get out of hand.

There was no authority governing this mayhem. The government enjoyed the sudden growth of money as they prospered further. Money grew and exchanged more hands.

Soon as economics says, this market had reached its pinnacle, the only way from here was a fast rollercoaster ride downhill.

Amongst this new set of ‘investors’ and ‘investing’ it didn’t take long for financial scandals to break. One of the first financial scandals to grip the Dutch was what is the Tulip Crisis. What seems to be a rather trivial name is one of the first major stories of a boom and bust cycle. Not many records exist from the day but the occurrence of such an event is definite in the history books.

The Tulip Crisis

Today, the Dutch call tulips their national symbol however tulips are not indigenous to this country. These beautiful colourful flowers originally painted the Central Asian landscape predominately, Persia. The Ottomans continued this romance with tulips and introduced them to the prosperous Dutch people.

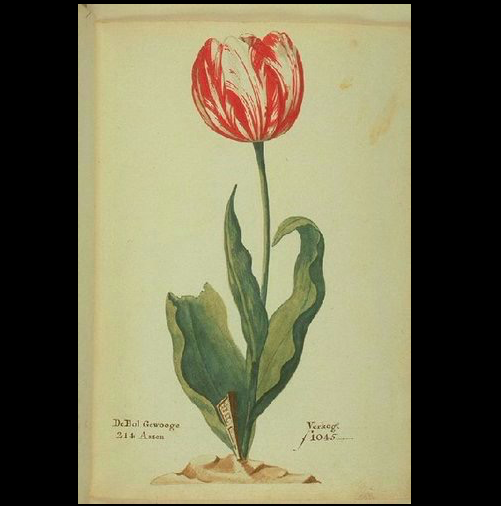

And thus, the Dutch got acquainted with tulips. Since it was an exotic, adventitious flower and so beautiful at that, Tulips soon became a status icon. The rich would splurge on beautiful tulips. However in this point in time, the tulip prices were on the higher side but not to unreasonable.

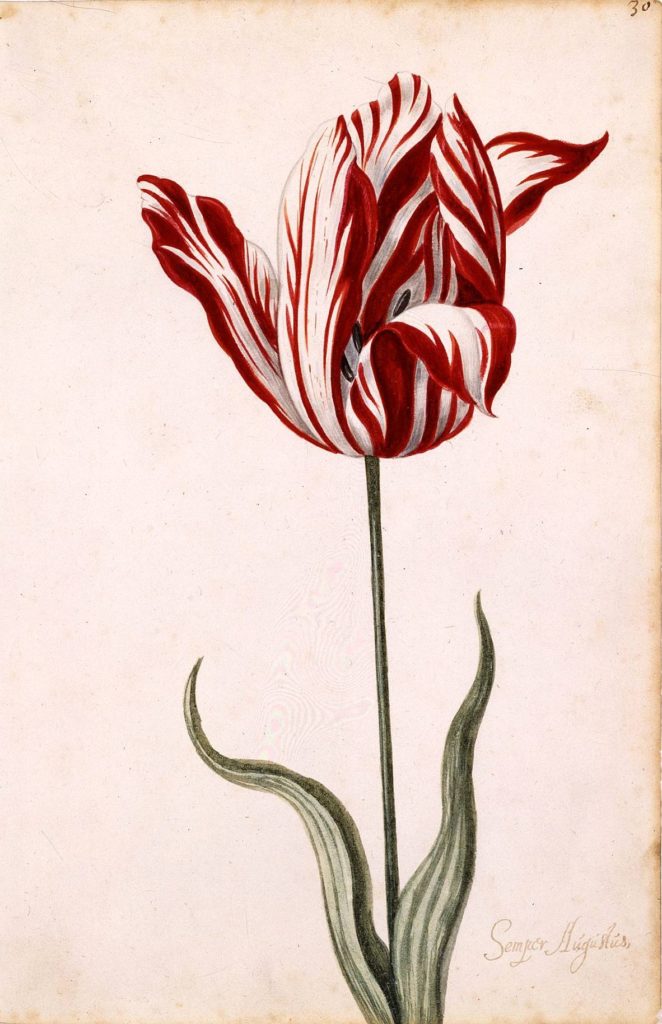

Carolus Clusius was a botanist who had taken an interest in tulips. He would study them and document upon these beautiful flowers. It was there in his private tulip gardens at Leiden that he noticed something astonishing. He had witnessed the ‘breaking’ of a tulip bulb.

What does that mean?

The tulips grow only in one colour, there is no other colour mixed on their petals. They are either blue, red, yellow, pink but not all colours together. During ‘breaking’ these colours on the petals mix with a completely new colour in a new vivacious pattern. Such tulips are a sight for sore eyes.

The Dutch in the 1600s shared these sentiments of mine. These ‘breaking’ tulip bulbs grew in popularity. People got into the profession of ‘creating’ and ‘preserving’ such bulbs. Dutch botanists worked on cultivating more and more such colourful patterned tulips called ‘cultivars.’

The tulip which had been a status symbol saw its value shoot up in the eyes of the people. The creme de la creme and the aristocrats simply had to get their hands on a cultivar.

Out of the new hybrid tulip bulbs, one of the varieties commanded a higher value- Semper Augustus. It was a beautiful white and red patterned hybrid. People offered astronomical prices to pick up ten of these, even as high as 12,000 guilders (Dutch currency). 12,000 guilders equated to a proper house in the prime locality in Amsterdam! And bare in mind, the real estate prices in the city were the highest back then.

In the 1630s, the word of these hybrid tulip bulbs reached neighbouring countries. The French and their love for all coquettish items came down on these tulip bulbs like vultures on a dead corpse.

By 1633 the race to get the most exquisite flower, Semper Augustus had grown. People would buy these bulbs with no intentions of planting them for regrowing. These bulbs would then to sold again to other eager buyers.

Legend has it, people soon became rich overnight, even faster than the stock exchange. As one’s friends became rich, more and more tried their luck at Tulip bulb trading.

————————-

Here is what 7 Instagrammers have to say about their most influential women in history

————————

Why not simply plant the Tulip seed?

This strange tulip hybrid could only be achieved through the tulip bulbs. The tulip seeds couldn’t create a tulip which was ‘breaking’. No one was interested in the single coloured tulips anymore.

There came a point were a single tulip bulb would trade for 5,500 guilders. By 1636 this price had shot up to 10,000 guilders for one tulip bulb!

At its prime in 1633-1636, the tulip bulbs exchanged ownership about 10 times per day and that to in an age without internet trading!

At such a rate it was impossible to exchange tulip bulbs manually. There was also the problem of the ‘off-season.’

However the seasons couldn’t deter the greedy. The people created contracts that promised to buy the tulip bulbs at a future date for a particular sum of money. This is what financial professionals term a futures contract. This is the first time in history the ‘futures’ concept was used.

That is not all, some historians believe that these futures contracts were further traded as well. They were further bought and sold for a higher price.

By 1637, this tulip market had reached its peak. Money exchanged hands when there were no tulip bulbs to trade. The prices had risen so high that it would require a person to sell prime real estate to purchase a single bulb. To make matters worse, documents suggest that people literally sold their houses. However I doubt how much of that is true.

People really can do anything to money though, can’t they?

On one fine day in 1637, the tulip bulb buyers had had enough. The were sick of the hybrids and just didn’t turn up for a tulip bulb auction. This proved to be the pin that would prick the balloon.

The Tulip Bulb boom had burst and there was only one way to go- down.

Prices crashed just as quickly as they had grown. People were left with contracts they couldn’t honour. People lost their houses, money and were left with a bunch of worthless tulip bulbs. But on the bright side, they could start a floriculture business!

The Dutch government intervened declaring that all futures contracts must be honoured for at least 10% of their value. Instead of having a positive impact, the situation worsened. Prices further dropped.

And that was the end of the Tulip Crisis.

—————————-

—————————

Aftermath

A century later, botanists revealed that what most considered to be a beautiful phenomena was a devil in disguise. The ‘breaking’ of the tulips was a virus that spreads on tulip bulbs. This virus is not mortal however its a virus nonetheless. Growing tulips using its seeds stops this virus from spreading. This may be the reason why tulip seeds couldn’t create ‘cultivars.’

The Tulip Crisis is a hot debate topic. Some believe that this crisis created a turmoil in the Dutch people’s financial lives whereas others believe this crisis never took place on a large scale. Evidence and reports from the 17th century are very little to assert much about the Crisis. Whatever may be the truth of it, it definitely made the Dutch, go Dutch:) Their spending and investing methods turned to be more protective.

So the next time you go Dutch, remember that phrase may have some root in the Tulip Crisis:)

Tweet This:

Financial scandals can be really stupid at times especially when people almost sell prime real estate to buy one tulip bulb. Find out what happened during the Tulip Crisis-… Click To Tweetor share on other social media platforms using the icons below.

What did you think about this new venture of mine- writing about financial scandals? Comment below for suggestions

—————–

If you want more such articles and a special surprise, type in your email here.I promise I do not spam:)

Until next Friday- write to me editor@giglee.in for suggestions, new topics you’d like to know more about from history

http://giglee.in/chanel-nazi-spy/

Comments

How interesting !!whether the scam actually took place or not the people back then still knew about booms and crashes otherwise this story would not have spread

Oh yes, that is a very different way to look at it. I guess when people loose big money, they tend to remember their mistakes and stop future generations from erring. It is also interesting to know that the Tulip Crisis is something similar to what might happen in a commodities market like the Onions market so its still very much relevant…