Story of the Bombay Stock Exchange

Ever Expanding: The Story of the Bombay Stock Exchange

From a beautiful bay to India’s financial guru, the journey of Bombay and its Stock Exchange

As the rush hour trains reach CST, people jump out, there is no time to linger about, they are on a tight schedule and the clock’s ticking. Outside the station, the queues for a share taxi are expanding and there is a probability of being late for work.

Life is tough, as it has always been in Bombay. This city which runs on the sole principal of ‘Time is Money’ has no time to stop and take a break. Money is what every single heart living in Mumbai wants.

This city is a strange soap opera. The people, businesses, technology is ever changing but Bombay’s love for Money, has always been constant.

But Bombay wasn’t always a money making factory. Some historians say that the origin of ‘Bombay’ comes from Bombhaim meaning a beautiful bay in Portuguese. And the Bombay of the 17th century was indeed an inhibited paradise with canopies of coconut trees and water all around.

It was when the British Crown won over a few islands and gave them on loan to the British East India Company that things began to take a turn for these seven islands. The East India Company saw the opportunity that Bombay provided being a safe harbour, something that wasn’t seen by the Portuguese or the British Crown previously.

It was then that ships began docking here: Parsis, Banias, Gujuratis and people from all over came to Bombay for one single purpose- to make money. Businesses bloomed, money exchanged hands and some people became rich. Rich enough to fund the East India Company’s infrastructure projects.

However as a student of commerce might point out, business don’t run solely on cash, they run partly on credit. Our good old Bills of Exchange or Hundis had always been in use since the medieval times all around India. They were a note of assurance that the money would be paid at a future date. However these Bills of Exchange were used for businesses only and weren’t traded on a stock market.

The original traces of a serious kind of investment instruments were a type of ‘term papers’ issued by the East India Company in the 18th century. For a person without cash, he could hand over these ‘term papers’ for a promise to pay at a later date with interest. Unlike a Bill of Exchange, these term papers could be further sold multiple times till they matured.

A few decades later in 1830, banks and cotton pressing businesses grew exponentially and buying a share of these companies seemed attractive. It was maybe this sudden growth that laid the roots for stock broking in Bombay as well as India.

A few years later, Banks and the businessmen recognised 6 brokers. The registered ‘office’ of these 6 brokers was the Banyan tree at the ‘Town Hall.’ Today a Mumbaikar would know this place as the Horniman Circle opposite the Asiatic Library.

When talk spread over town about these strange set of ‘brokers’ and the bucketloads of money they made, some adventurous sorts wanted in too. Within a span of 30 years, the number of brokers grew to 50. If things seemed to be going good, they would soon be better.

The American Civil War began in 1860. This meant that the trade between Britain and America had temporarily ceased. Demand for goods especially cotton from Bombay increased further.

More money was sought for, the brokers grew to be 250 in number.

Up to this time though, trading was a gamble. There were no rules or regulations. And the techniques used to make money would make you laugh today.

—————————

If you are enjoying ‘Story of the Bombay Stock Exchange’

You might like to read about the first Financial Scam in India

————————–

At Phydonie (near Girgaum) in Mumbai, a few brokers would assemble for a ‘barsaat-ka-satta’ or better described to be gambling during the monsoon.

The brokers would bet about the amount of rain and the time it would take to fill containers. This risky gamble was of two types: Calcutta More which calculated the time and amount of rain that would fill a box loaded with sand and a Lakdi Satta that would calculate the amount of rainfall and the time required to fill the gutter of the roof!

To bet on such things in near stupidity even if these gamblers in the 1800s weren’t as badly affected with global warming and changing seasons as we are today!

When rain bearing clouds didn’t fill the sky, money was to be made in cotton.

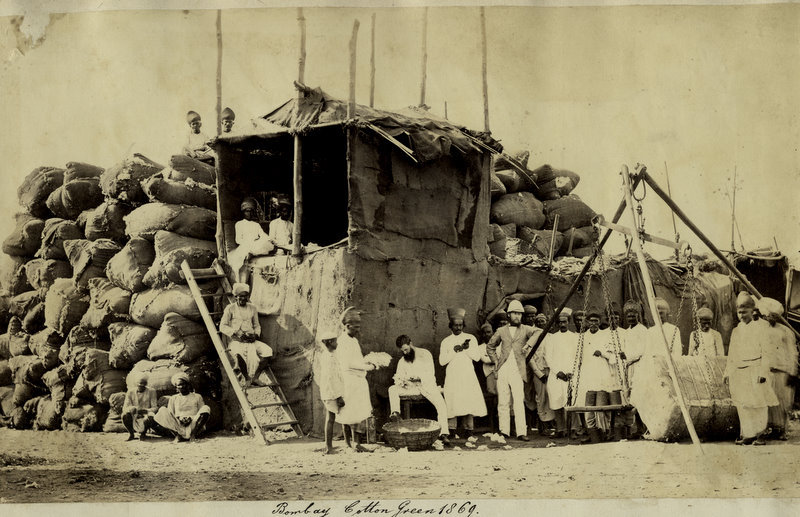

The demand of cotton, records suggest, grew to a staggering amount of 70 million pounds sterling! The economy was growing at a fast pace, almost overtrading with no regulations. 36 banks, 24 insurance companies, 60 stock companies and 8 development companies flooded the market to fill this demand.

.

And then the Civil War ended. The demand for cotton in Bombay, reduced. Most of these businesses, the brokers and everyone involved in this rapid churning wheel went bust. The wheel had stopped spinning, there was no more money to be made.

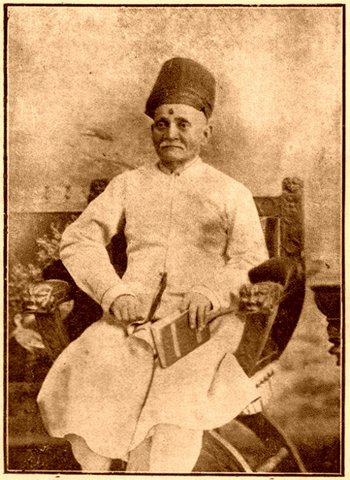

It took the big names of business like Premchand Roychand eight years to re-establish themselves however never to reach their previous glory.

This devastating bust taught Bombay a few lessons.

When the brokers began picking up the pieces, they glued them back in place with a few rules and regulations.

Ten years later, Bombay saw its stock exchange rebuild itself with a formal name: Native Share and Stockbrokers Association. They followed this with a formal charter that laid down a few foundation rules and principles still followed by the Bombay Stock Exchange today.

However these Dalals still didn’t have a proper office to got to. From under the Banyan tree they had changed several locations hopping around the same area from one lane to the other as their numbers grew. It was a sort of warning: as brokers would spill out on the streets, it was time to move on to a bigger place.

As the century turned, exactly 100 years after those 6 brokers who traded under the Banyan tree, these Dalals moved to the street we all call Dalal Street at the same place where the Bombay Stock Exchange (BSE) proudly stands today.

The journey after this for the BSE was not an easy one. It was one of struggle for survival after independence when the newly independent India aimed for socialism. The strict license raj didn’t help either. The brokering profession was stereotyped as gamblers.

——————————–

If you are enjoying ‘Story of the Bombay Stock Exchange’

You might like to read about the History of Stock Market

——————————–

In 1991 when India reached near bankruptcy and the World Bank asked PV Narasimha Rao and Manmohan Singh to open up the economy for global trade, things changed for the better.

The first stock exchange of Asia, the BSE, saw an influx of investors just like it had seen when it the 1860s.

In 1992, the Securities and Exchange Board of India (SEBI) was formed that brought regulation in financial markets.

Three years later in 1995, BSE took trading online all within a span of 50 days.

Today when the rest of the city rushes around the BSE, bull and bear markets come and go, the BSE grows larger and larger embracing the technology and crowning itself to be the fastest stock exchange in the world with a transaction speed of 6 microseconds!

As the city of Mumbai talks more and more about investing, its billboards filled with advertisements on new Initial Public Offerings and easy ways to invest in Mutual Funds, money grows pushing our BSE to become the 10th richest stock exchange in the world right next to the NYSE, NASDAQ, FTSE, Tokyo Exchange and Shanghai Exchange.

And this is not the end of transformation at BSE. As history has told us for 150 years now, just like our Mumbai the exchange evolves with a singular objective: to play with money.

If you liked reading ‘Ever Expanding: The Story of the Bombay Stock Exchange’ please share it with your friends on social media!

NOTE: The Bibliography for this post is missing. Please help us credit the sources that deserve it. If you believe your work, or a work you know of needs to be cited here, please write to editor@giglee.in to inform us. DISCLAIMER: The intention of this article is not to hurt anyone's sentiments. The thoughts expressed in the article are purely those stated by the author of the work. The information provided on this website may not be complete, reliable, accurate and/or updated. The details you share with the website will not be shared or sold. We are not liable if in case of theft, your data is stolen. The content on this website is provided without any warranties whether express or implied. If you have a doubt, query or complaint please write to editor@giglee.in and we shall respond as soon as possible.