History of The Stock Market

History of The Stock Market

The Biggest Tool of Today’s Era of Capitalisation is the Stock Market. Let us explore the story of how this market came to be & evolved

*Scroll down below for the glossary to uncover all the technical terms:)

Every newspaper, news channel and e-newspapers keep going on about the Sensex, the stocks and where to invest. Instead of the horrid humid weather and animated political talks, people consider it cool to discuss about this thing called the stock market.

What is this strange market we call the ‘Stock Market’?

To the uninitiated, stocks are simply a way to gain part ownership of a company. These stocks are first sold by the company to some people. These people further sell their stocks to others thus transferring their part ownership to the new buyer. This buying and selling of stocks takes place in a ‘Stock Exchange’. Together, this entire system is what we collectively call the ‘Stock Market’

The History Of Stock Market

The story of how stock markets came to be is very fascinating. It is so because the first stock exchanges never traded any stocks!!

The initial building blocks of what resembles today’s stock exchange can be traced back to 12th century France.

The French society had come up with an occupation titled ‘Courtiers de Change’. These people were appointed by the French Government and acted as an extension to the banking system. Their work was to trade debts. These Courtiers de Change would trade on behalf of people and earn some commission from the trade. A commission that we have come to call brokerage. Due to these early men, history anoints these Courtiers de Change as the first brokers.

At about the same time in Venice, the merchants there began trading securities too. In those early times, a proper system to govern and control such financial instruments didn’t exist. When the price of these government securities rose up and kept on rising, the government didn’t know what was to be done.

Instead of adopting proper legal measures, the government spread rumours of these bonds itself! Imagine what chaos must have transpired!

When push came to shove, the trading of such securities was banned in 1351.

Just when it seemed like the stock market had been sculpted, this idea seemed to have shattered in pieces too. But was it the end?

As we could attest today, it was far from it.

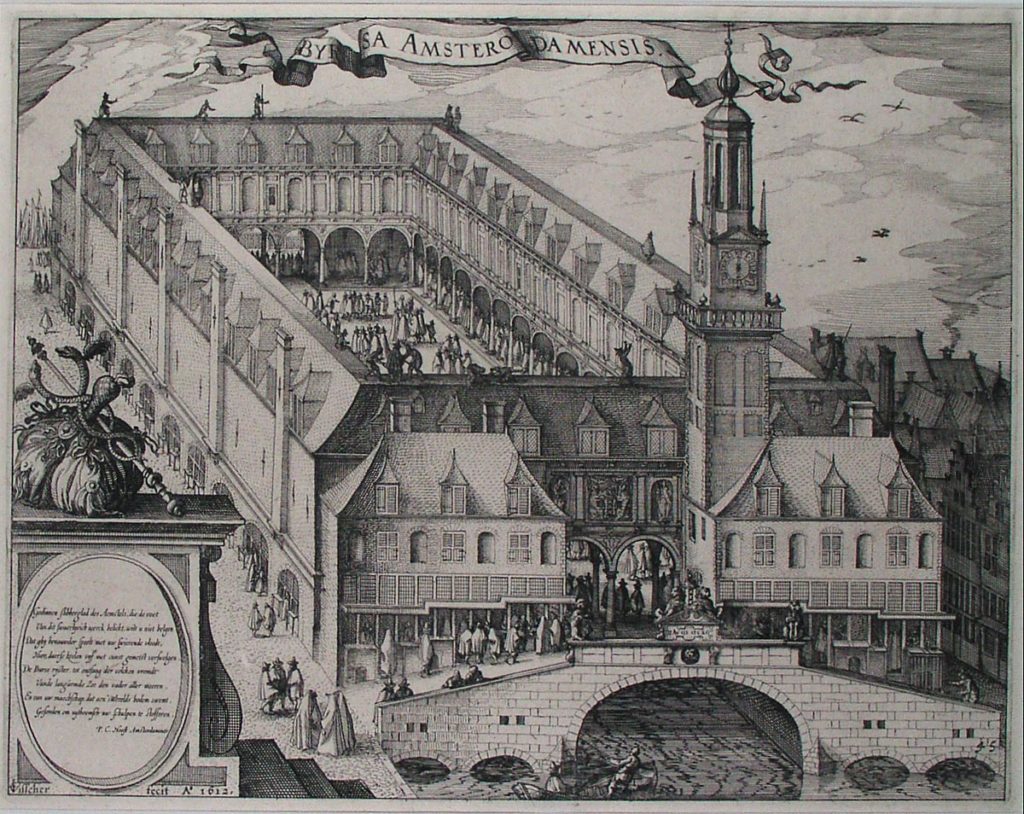

Brugse, a city in Belgium, caught this new trading flu as well. Merchants and some adventurous people assembled at the house of one Van der Beurze to trade. This activity of theirs became a massive hit amongst the people.

Their assembly grew and they moved out of the house of Van der Beurze and into one of this many premises. With this assembly the name ‘Beurze’ moved along with them too and came to define these set of early investors. They called themselves the ‘Brugse Beurse’.

Seeing this influx of new types of money making businesses, the Italians restarted their own trading game in the 14th century. This time it wasn’t just Venice but cities like Pisa, Verona, Genoa, and Florence who became the main centres for trading government debt securities.

However you must realise, till this time, the stock exchange had been around for a good 200 years but it had yet to trade a stock. Instead all that investors would buy and sell were government debt securities.

A man in Britain, Thomas Gresham, became fascinated with the stock market in the 16th century. Not wanting to be left behind, he constructed a stock exchange in London. Here is set up shops which would, for the first time in history sell actual ready to buy products. These were the first retail shops.

Gresham invited Queen Elizabeth I for the grand opening. The Queen was very fascinated by what she saw and not only gave her consent but let Gresham call this new exchange the ‘Royal Stock Exchange’.

The Royal Stock Exchange laid the grounds of Europe’s biggest stock market currently housed in London.

This exchange might have also been the first where commodities were exchanged meaning that actual real livestock was traded.

It was the 16th century, 400 years after those first brokers in France yet these institutions which called themselves ‘stock exchanges’ still didn’t trade any stock.

This was chiefly because a proper ‘company limited by shares’ wasn’t yet invented.

It was in 1602, when Verenigde Oostindische Compagnie better known to us as the Dutch East India Company thought about public funds as a way to finance their expeditions towards India and Asia as a whole that a company was formed. It was then that something akin to stocks came to be.

The Dutch East India Company sold stocks per voyage. Every new ship that would go on a voyage would be divided into stocks sold to investors. Since most of this 8-10 month long voyages would fail, investing in one ship was a risky proposition. To avoid this, most poeple would buy multiple stocks in various ships.

It is of no wonder that the Dutch East India Company became the wealthiest company ever to exist. Its value in the 17th century was 78 million Dutch guilders. To convert this sum to today’s time, the company would be valued at $7.9 trillion dollars today! Putting this into perspective, the top five tech companies like Apple, Microsoft, IBM, Intel and Alphabet (Google) make a mere $3.5 trillion.

This almost unstoppable VOC finally hit the rocks during the Dutch Tulip Mania.

——————————-

Enjoying ‘History of The Stock Market’

You might like to read about the Tulip Mania

——————————

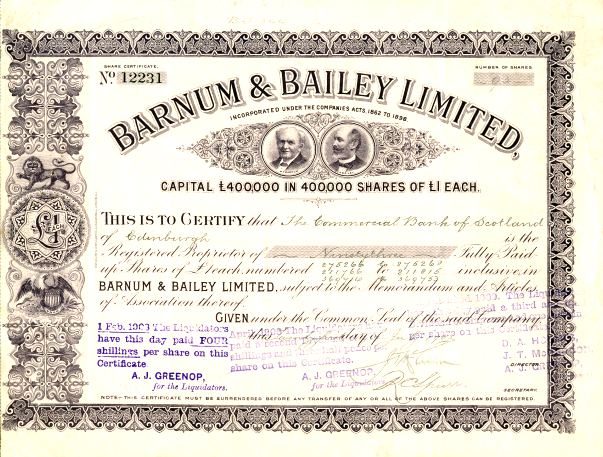

The British wanted to compete with their Dutch counterparts too. The British East India Company, which might not have been the wealthiest but the most dangerous of the lot, was the first company in the world to sell stocks like we do today.

The company instead of selling stock per voyage, began selling the stock of their company as a whole. A part ownership in exchange for some amount of money.

This was a tremendous success because the risk in such an agreement was lesser and the profits that the company would earn, mostly all the loot from India, would be distributed to the shareholders as dividends.

This new method of selling stock was welcomed by all shrewd minds, seeing that it was a massive success. Welcomed by minds that knew how to make easy money.

Due to a dangerous lack of rules, it was a piece of cake to float (to form a company) and sell shares of a company even before you began selling anything!

Companies would be formed for silly things, even things that were so important, they couldn’t be disclosed! And greedy investors would invest in such companies!

It was probably due to this hysteria that the first bubble of the stock market bloated and popped.

The South Sea Company bubble would be the first of its kind in history.

The South Sea Company was floated with a promise to start a business in the near future. For this the company began collecting public money.

The madness to purchase this share went so out of hand that women were willing to sell jewellery to buy a single share.

When things reached boiling point, people suddenly realised, the stock of this company that people had bought didn’t really exist or trade in the first place. The needle had pierced and the bubble popped!

After this the British government stepped in to tidy the damage. They simply banned trading of shares till 1825.

The next biggest change for a Stock Market came when the New York Stock Exchange came into existence. It was an added advantage that the British had put a ban on trading. The location of this exchange, coupled with a lack of serious competition, helped New York Stock Exchange steadily grow into the giant it is today.

The NASDAQ stock exchange changed the tide after its introduction in the 1970s. This electronic stock exchange shook the reigns back in London as well.

——————————-

Enjoying ‘The History of Stock Market’

You might like to read about The First Major Financial Scam in India

——————————-

Britain’s Iron lady, Prime Minister Margaret Thatcher made plans to take the London Stock Exchange online too. The media dubbed this the ‘Big Bang’.

Since these early computer era reforms, ‘stock exchanges’ aren’t a place where stockbrokers gather to shout out stock names. Electronic trading has quickened the pace of trading. The biggest stock exchange NYSE sees 2-6 billion stocks change ownership every day.

The Bombay Stock Exchange is ranked 10th largest in the world. It is the fastest stock exchange in the world though with a median trade speed of 6 microseconds. Apart from this, the BSE might be the only institution except for the Bombay High Court to be named after Bombay, the former name of Mumbai.

What is the future of the stock market? With the added interest in the investment field, stocks are here to stay along with the new and upcoming methods to invest money. I am sure stocks would be around as long as money is!

What do you think? Comment below

Did you enjoy reading ‘History of The Stock Market’? Share it with your friends on social media too!

Glossary-

Government Debt Securities- A government debt security is a bond issued by a national government, generally with a promise to pay periodic interest payments and to repay the face value on the maturity date.

Company Limited By Shares- ‘Limited by shares‘ means that the liability of the shareholders to creditors of the company is limited to the capital originally invested, i.e. the nominal value of the shares and any extra amount paid in return for the issue of the shares by the company.

Dividends- A dividend is a distribution of a portion of a company’s earnings to its shareholders (owners)

Bibliography

Bang Crash Wallop- Iain Martin

The rest of the Bibliography for this post is missing. Please help us credit the sources that deserve it. If you believe your work, or a work you know of needs to be cited here please write to editor@giglee.in to inform us.

The intention of this article is not to hurt the sentiments of anyone. If you have a doubt, query or complaint please write to editor@giglee.in and we shall respond as soon as possible.

NOTE: The Bibliography for this post is missing. Please help us credit the sources that deserve it. If you believe your work, or a work you know of needs to be cited here, please write to editor@giglee.in to inform us. DISCLAIMER: The intention of this article is not to hurt anyone's sentiments. The thoughts expressed in the article are purely those stated by the author of the work. The information provided on this website may not be complete, reliable, accurate and/or updated. The details you share with the website will not be shared or sold. We are not liable if in case of theft, your data is stolen. The content on this website is provided without any warranties whether express or implied. If you have a doubt, query or complaint please write to editor@giglee.in and we shall respond as soon as possible.